“Credit card rewards can be a special treat, like a leftover slice of birthday cake. As nice as it is to have that extra slice tucked away in your fridge, it only has value if you get to eat it.”

— US News, “Stop Hoarding Rewards: Inflation Is Coming for Your Credit Card Points”

Last month, the article quoted above hit my news feed, and I couldn’t agree with it more. It cited not only the effects of inflation on stored rewards points just sitting unused in accounts for years (and not earning interest!) but also the eroding redemption value of points from airlines, hotels, and the credit card issuers themselves.

While there are many sites on the Internet that recommend credit cards, I thought I’d share what we do in our household. Over the years, we took some steps to mitigate the impacts of “point inflation” by seeking cards with either cash value or special benefits.

For full disclosure, Marsha and I are also subject to the issues of “point inflation” with the Chase Ultimate Rewards points we are awarded through our JPMorgan Reserve card (equivalent to the Chase Sapphire Reserve), alongside the Chase Ink Business Unlimited Card, which I use to keep expenses separate for my consulting business. We do still have a small hoard of points, which we use primarily to transfer to World of Hyatt but also leave pooled to potentially take advantage of international travel options with other travel partners. Still, we hold this card more for its unique benefits than the pure return-on-investment (ROI) of the Ultimate Rewards points which always seem to decline in value.

To cut to the chase (intentional play on words!), here are the other cards besides our Chase cards (in alphabetical order) that we use that offer either higher cash returns or special benefits on their own.

(UPDATE: Paywall removed for Christmas 2024!

Reminder, as described in Sunday’s post, this my first “B-sides” post with the “paywall” on. “Paywall” is in quotations because my objective isn’t to make money on this but rather to encourage regular reader engagement to get me to keep writing! For those who are already paid subscribers, my coffee addiction and beer belly thank you! For others, feel free to use the trial offers, send me a message with a story of how this Substack has affected you for a comp’ed month, or refer friends to this Substack for a comp’ed subscription.)

The list:

Capital One “old” Savor (no longer available to new cardholders at the 4% rate)

These are the rules we use to maximize our benefits:

Eating out - use the Capital One Savor (4%)

Groceries

If not Whole Foods or Costco, use the American Express Blue Cash Preferred (6%)

If Whole Foods, use the Amazon Prime Visa (5%)

If Costco, use the Costco Anywhere Visa Card (2%)

If a place that doesn’t accept American Express, use the JPMorgan Reserve (points)

Gas stations - use the Costco Anywhere Visa Card (4%)

Travel

If Alaska Airlines, use the Alaska Airlines Visa

Otherwise, use the JPMorgan Reserve (points)

Online purchases

If Amazon.com, use the Amazon Prime Visa (5%)

Otherwise, use the Capital One Venture (2%) with an Eno virtual number! Don’t forget to check Capital One Offers!

Streaming services

Use the American Express Blue Cash Preferred (6%)

Business expenses

Use the Chase Ink (points)

Otherwise

Use the JPMorgan Reserve (points)

Why?

Some highlights of my criteria to use other cards besides the Chase.:

High rebate percentages

Redemption options

No annual fees or easy payback of values

Unique perks

Security

The sections below will explain the logic!

High Rebate Percentages

Some of the cards offer particularly high rebate percentages in cash, above the traditional 1% (1 point per dollar) offered by most credit cards on the market. I am not including the cards here that rebate with travel points or miles that aren’t easily convertible to cash.

6%

The American Express Blue Cash Preferred is our preferred choice paying 6% for the first $6,000 of groceries per year. The limit of $6,000 doesn’t typically pose a problem for us because we use the Amazon Prime card at our neighborhood Whole Foods. Also, our nearby Japanese food store (Uwajimaya) no longer takes American Express.

In addition, the 6% cashback applies to streaming services, which we use for both our Spotify and Netflix subscriptions. On top of that, we get a $7 / month rebate for our Disney+ bundle (Hulu, Disney+, and ESPN).

5%

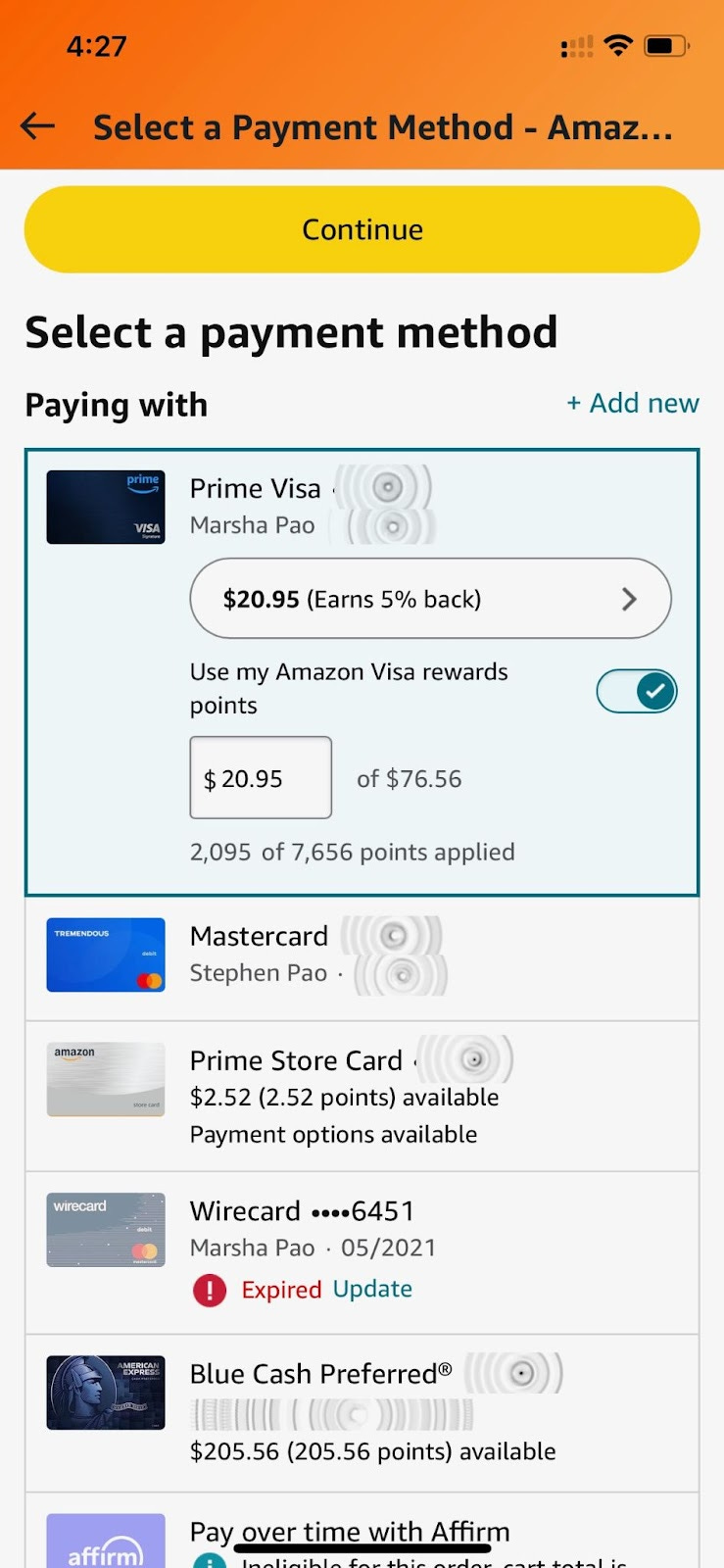

All of our Amazon.com and Whole Foods purchases earn 5% when we use our Amazon Prime Visa. These rebates come in the form of points when purchasing on Amazon.com. For us, these points are like cash, and we can simply apply them as credits at checkout for any purchases.

4%

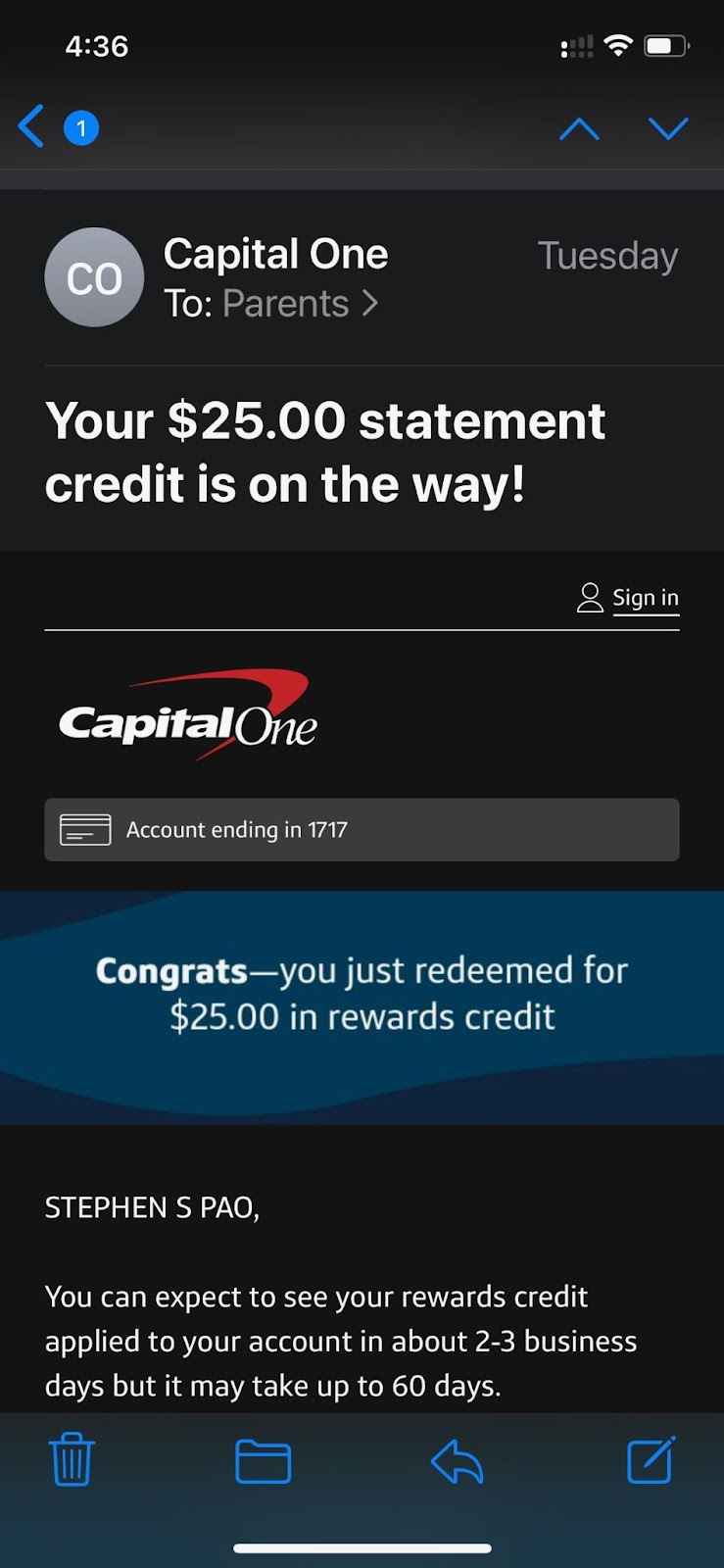

The Capital One “old” Savor card provides 4% cashback at bars and restaurants. So, for every $625 we spend going out, an automatic $25 cashback rebate is credited right back to the card bill. There is no point hoarding here, just direct benefits! (The “new” Savor card offers only 3% but has no annual fee.)

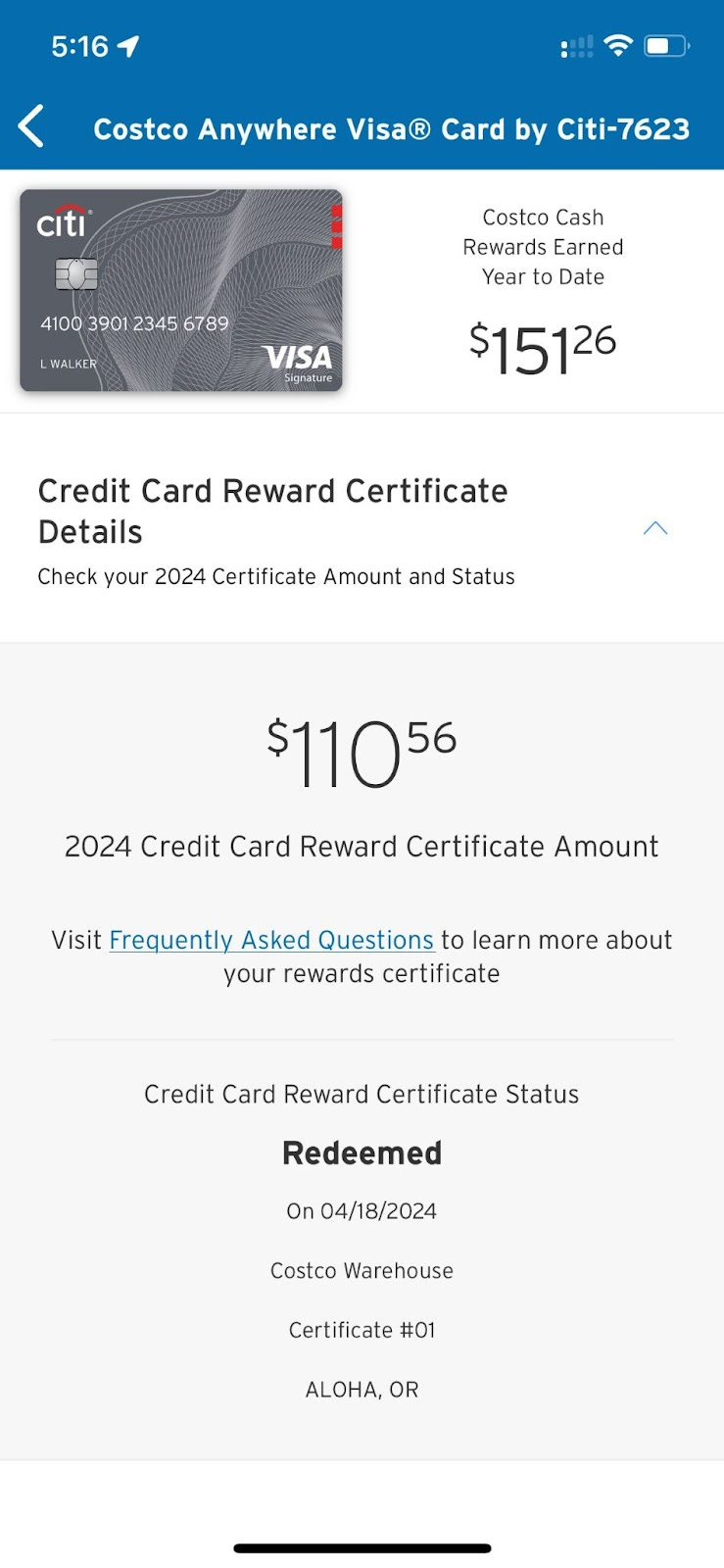

The Costco Citi card provides 4% cashback at gas stations for the first $7,000. While we almost never drive around town, we have been heading up from Portland to Bellevue to visit Marsha’s brother. Still, we have never even come close to hitting the $7,000 limit. This cashback comes in the form of a Costco gift certificate once per year. For us, Costco gift certificates are practically like cash!

2%

The Costco Citi Card provides 2% cash back for purchases at Costco. For Costco purchases, using this card is preferred.

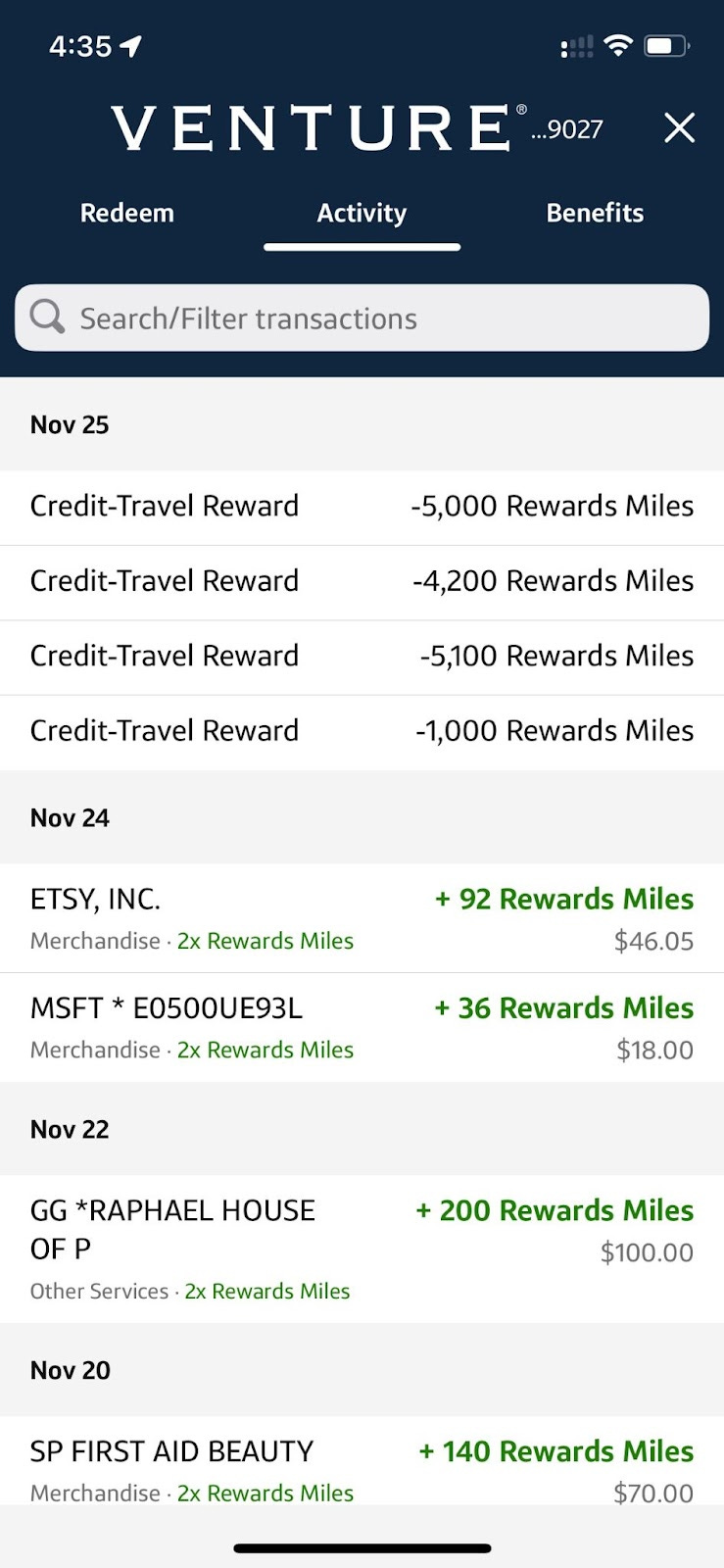

The Capital One Venture Card provides 2% cashback for use on past travel purchases on the Capital One Venture Card or even future travel purchases through the Capital One Travel website.

Redemptions

There are many mechanisms to redeem the rewards from cards that offer cash rebates.

Automatic redemption

My favorite card for automatic redemptions is the Capital One Savor card. Automatically, after $625 of spend, an email just appears in my inbox when $25 of statement credit is available to me. Easy.

Credits off purchases

I love the ability to just apply Amazon Prime Visa reward points directly to a purchase on Amazon.com. It’s very easy to use Amazon Visa reward points immediately just as another payment method in the cart!

Statement credits

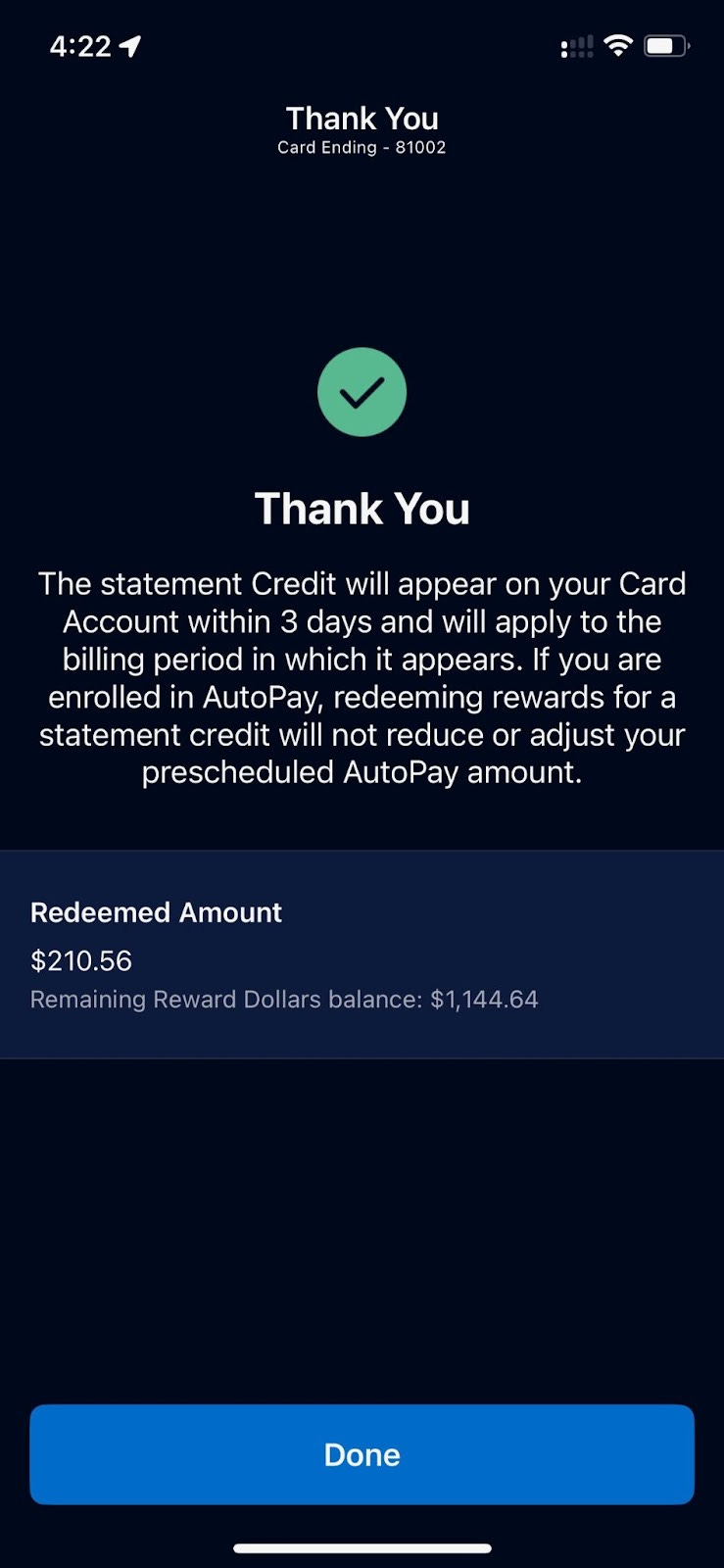

Both the American Express Blue Cash preferred and the Capital One Venture card allow me to apply the monetary rewards right back as credits to my statement. It requires some work on my side, but the ability to use the mobile apps to apply these credits makes everything pretty easy!

It’s particularly easy with American Express Blue Cash Preferred, as the credits can be applied in any amount right from the mobile app.

The Capital One Venture card redemption works very well for “erasing” travel purchases as statement credits, but it does require some work to use to “erase” charges one-by-one. I just did four of these.

One-time rebate check

The Costco Anywhere Visa issues a rebate check once a year. It’s their way of getting people back into a Costco warehouse! We almost never drive, but we do drive to Costco to stock up on supplies! Last year, we had a check worth over $100! Unfortunately, this rebate check didn’t pay for our whole trip to Costco!

No annual fees or easy payback

We always consider the payback of cards.

No annual fees

The Citi Costco has no annual fees. The 4% cash back on gas makes it worth it just to hold this card. Also, because the 2% cash back for purchases at Costco comes in the form of a Costco gift card, I generally like it better than the 2% cash back offered by Capital One Venture Card in the form of a “point eraser” on a statement credit.

The Amazon Prime card also has no annual fees. Of course, card members must also be Amazon Prime members, but we were already loyal members of Amazon Prime, both for the “free” shipping and the streaming service (some of my personal favorites included Reacher, Tom Clancy’s Jack Ryan, and Man in the High Castle).

The Chase Ink Business Unlimited card also has no annual fees. I just use this to separate business expenses. Doing so allows me to indiscriminately import my credit card actions into Wave for bookkeeping without data entry for each credit card transaction.

Easy payback

The American Express Blue Cash Preferred has a $95 annual fee. This one pays for itself with the 6% back on groceries itself. It only takes $1,583,33 of groceries to pay back the card charge. The streaming services are just a bonus. This card pays for itself early in the year, and the rest is just a bonus!

The “old” Capital One Savor card has a $95 annual fee. With a 4% cash back, it only requires $2,375 worth of eating out to pay itself off. Based on how often we use it living in an urban setting, it’s probably the easiest of all of our cash cards ro see how the rewards add up quickly! This one pays for itself early in the year, and the rest is just a bonus! (Note: the “new” Savor card has a $0 annual fee and is a better deal for anyone that spends less than $9,500 per year eating out!)

The Alaska Airlines Visa has a $95 annual fee. This one pays for itself with the Companion Fare for $122. For any ticket that would cost more than $217 roundtrip, this one pays for itself, too. We don’t use the Alaska Airlines Visa for anything else other than flights on Alaska, so it doesn’t take away from other programs.

The Capital One Venture card for us has a $59 annual fee (at least as of the last time we were charged on January 22nd). This appears to be a grandfathered rate. The 2% back on any purchase to erase any travel purchases on the card isn’t bad as a “catch all.” It takes $2,950 of purchases to pay back the annual fee outright or $5,900 of purchases on this card to pay back more than the 1% offered by the other cash back cards.

With the new annual fee of $95 starting in 2017, I think the Capital One Venture might be harder to justify, as it would require purchases of $9,500 per year to pay back more than the 1% offered by other cash back cards.

Harder Payback

The JPMorgan Reserve has a harder payback calculation. It is $550 per year for the first card and $75 per year for the second card. So, we pay $625 per year for it. We get a $300 travel credit, but this card still costs $325 per year, which we justify almost entirely by its unique perks rather than the value of the points.

Unique Perks

Primary Rental Car Insurance Coverage

So far, my favorite card perk has been the primary rental car insurance coverage offered by the JPMorgan Reserve card. When driving up to Bellevue, we hit a blown-out tire fragment on the freeway in a rental car. Unlike with the secondary car rental insurance coverage offered by other cards, the card’s primary coverage paid the $1,300 bill to Enterprise Rent-A-Car without even reporting it to my own insurance company. Moreover, once I gave both Enterprise and the JPMorgan Reserve Card claim numbers to each other, I didn’t have to be involved! I felt really lucky that we didn’t drive our own car up that time because I would have been otherwise dealing with my own insurance and claims adjusters to fix the car!

UnitedClub, in addition to Priority Pass

In addition, the JPMorgan Reserve card has a unique perk, which is an undocumented UnitedClub membership. This is a benefit not offered to Chase Sapphire Reserve members. We enjoy this one when flying United! I love that UnitedClub has Illy coffee, and the UnitedClub at PDX is quite civilized when waiting for an outbound flight. We have found the clubs in both Denver and Chicago where we frequently connect to be quite busy, but it’s still nice to have this as an option! This perk is on top of the Priority Pass Select membership that is well known to the Chase Sapphire Reserve.

Alaska Free Baggage and Boarding Priority

The Alaska Airlines Visa offers both the first free checked bag, as well as priority boarding into “Group C” even when purchasing back-of-the-plane economy tickets. Even as economy travelers, we have not struggled to find overhead bin space since using the Alaska Airlines Visa for travel!

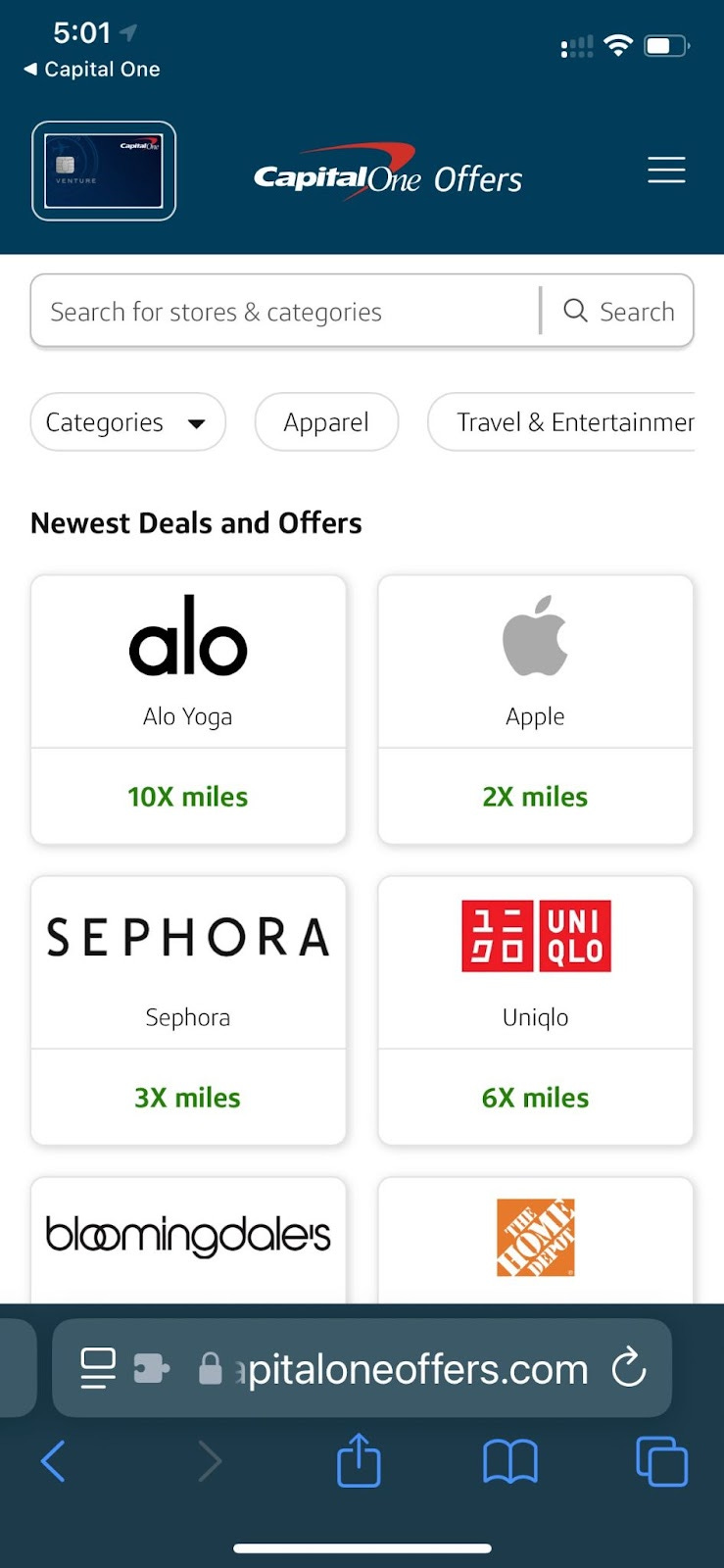

Capital One Offers

Capital One Offers has a really interesting perk, too, which are additional rebates exclusive to Capital One customers. These bonuses make it really compelling to use the Capital One app.

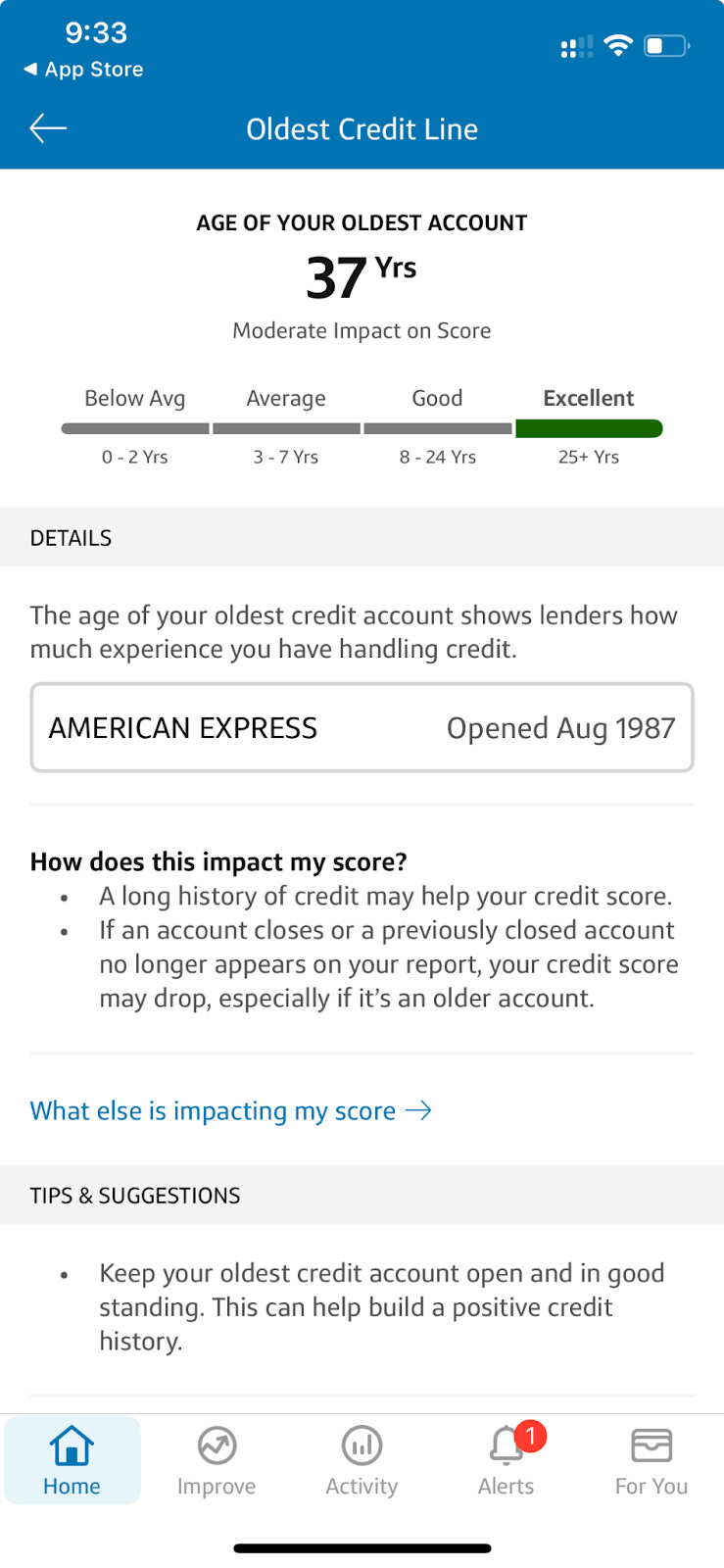

American Express Account History

One benefit of having an American Express card is that they maintain all the various card accounts as a single relationship across all of history. I have been an American Express member since 1987, starting with my green card in college. Throughout my career, I’ve also had a Gold Card and a Platinum Card. In my retired life, I found the best card for me was the Blue Cash Preferred. Even though I’ve changed my card numerous times, the credit reporting agencies still see my American Express relationship as 37 years! For the purposes of credit history, I don’t think I”ll ever quit American Express altogether.

Security

Some of the cards offer some unique security features, which I have particularly appreciated.

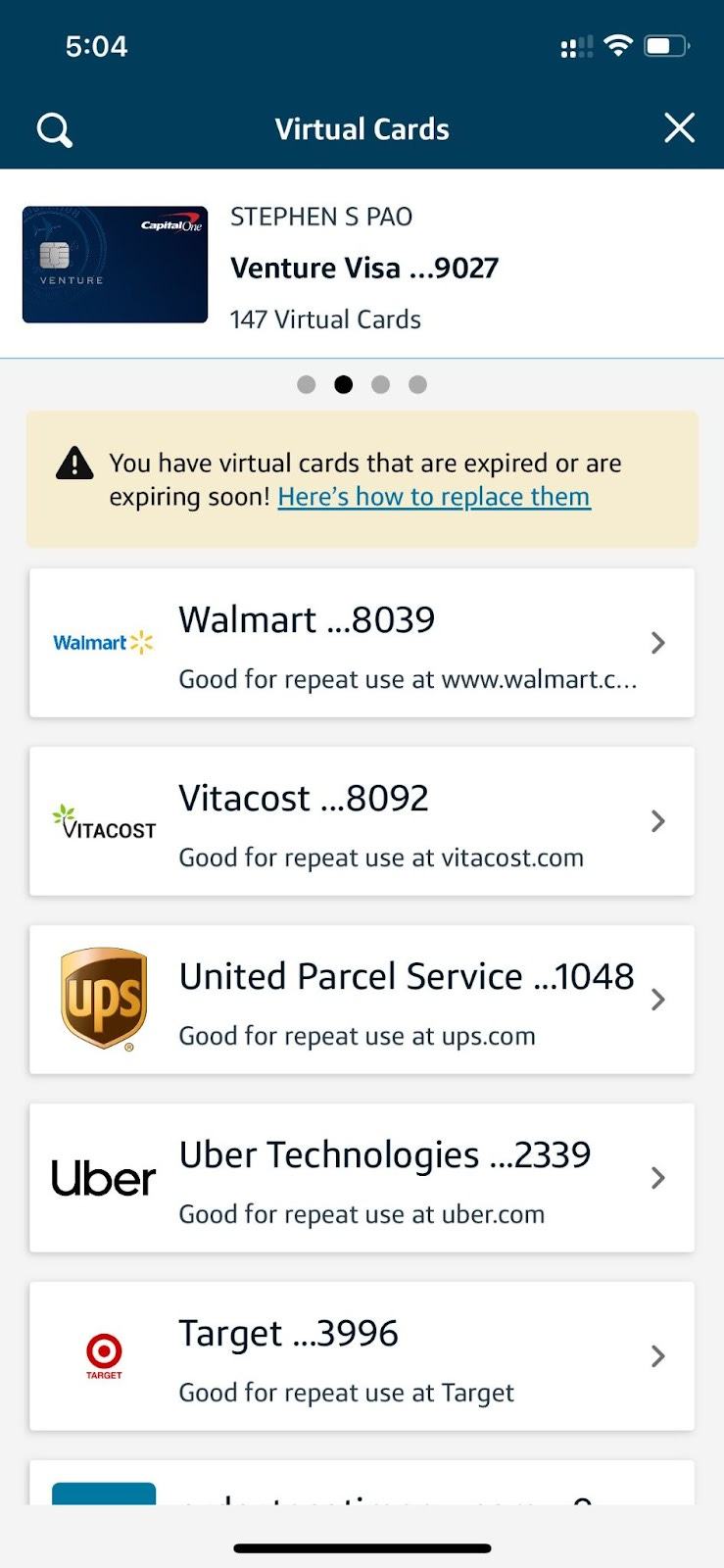

Virtual card numbers

My favorite security feature is the Eno number with the Capital One Venture card. Eno offers a unique virtual card number that can be cancelled if a site gets hacked without affecting the main card number. Each site where qw authorize recurring charges on my credit card has its own unique number. The virtual card numbers can be used with only one merchant, and use with another merchant account causes an automatic “Decline.” It looks like Marsha and I have created 147 of these!

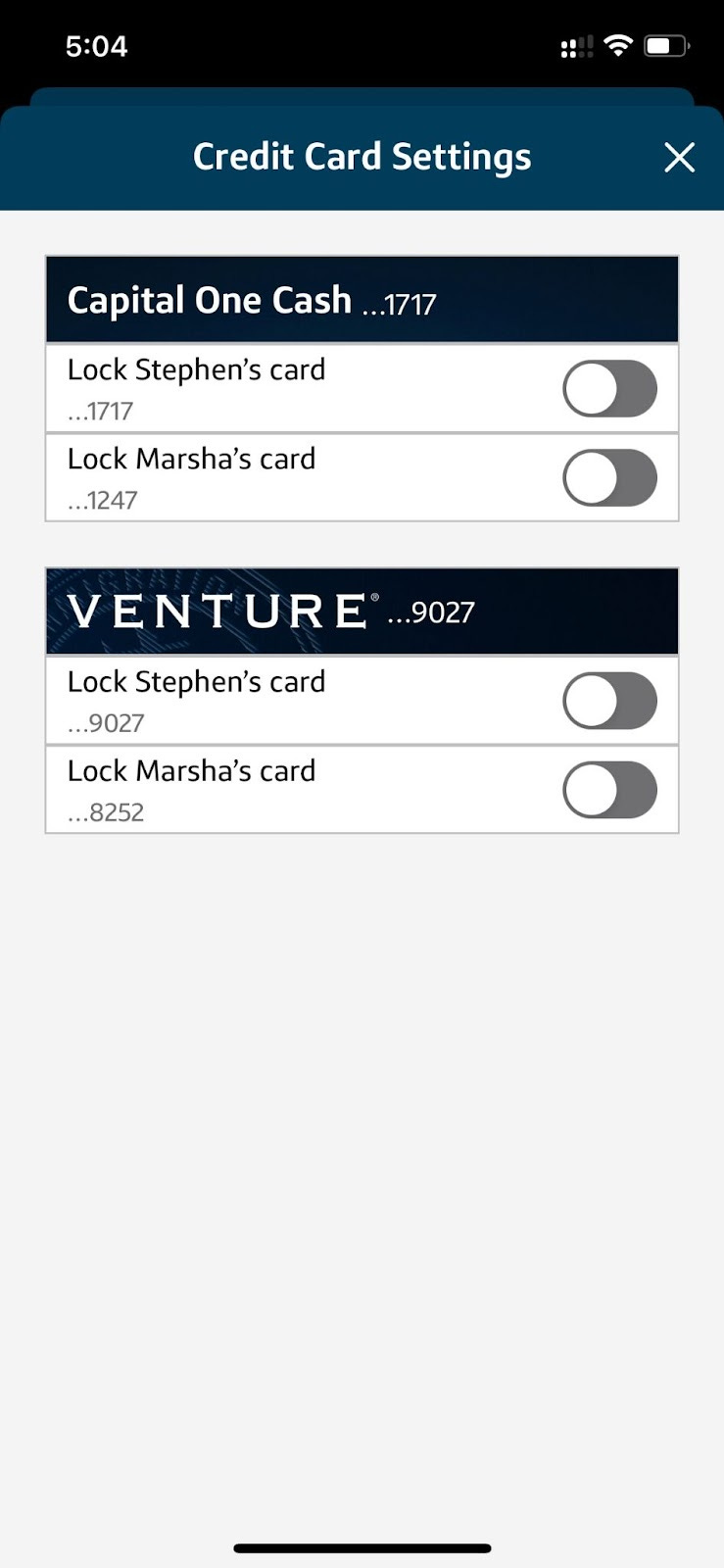

One tap “freezes”

There’s always a sudden panic that hits whenever I think I’ve left a card at a bar or restaurant. While not unique to any card, I thought it was important to note that all the major credit cards now make it easy with one-click to “freeze” cards from the mobile apps, including Capital One, American Express, and Citi. The screens look like this:

Custom photos

My Capital One cards came with the ability to print custom images on them. I uploaded photos with my family on them. It’s nice when splitting the bill with another party or when keeping a tab open at a bar because the server can always figure out which card to give back to me! Unfortunately, it appears that Capital One dropped this feature back in 2018! My renewal cards still come with the old photos on them, but I can’t change them!

Handprint Recognition

For me, the best card security has been not carrying the cards at all. I really appreciate Amazon One at Whole Foods where I don’t have to carry the credit card I’m using, and I also don’t even need to pull out my phone. By simply holding my hand above the reader when checking out, I can access Amazon Prime discounts and charge my Amazon Prime credit card at the same time!

Summary

In truth, this is all just sort of a game. With these alternative cards, we do avoid some “point inflation” for sure. In addition, I figure all of this effort probably amounts to about a 1% cash value over just using our JPMorgan Reserve card. And while the JPMorgan Reserve card does have some of our favorite unique perks, by adding some additional cards, we get other perks as well as some additional security features.